Complete loan payments: The loan principal in addition the total curiosity Charge. This variety doesn’t contain an origination payment.

It might be challenging to know which one particular is the best outside of all All those alternatives. This information will provide you with a list of 19 Private Loans so you may make an informed conclusion prior to deciding upon what’s ideal for you.

In the event your credit score score is adequate, consider refinancing to get a lower desire level. Shifting the personal debt to a more economical lender would unencumber many of that extra fascination cash to produce a dent inside the principal as an alternative.

Residence fairness loans House fairness loans Allow you to borrow a lump sum at a hard and fast level, dependant on just how much of the house you possess outright.

Our objective is to offer financial schooling, holiday recommendations, and home renovation Strategies. Look at our blog site to search out responses to lots of of the concerns concerning own funds and how to make your hard earned money go farther!

Unsecured loans typically element increased curiosity fees, decrease borrowing boundaries, and shorter repayment phrases than secured loans. Lenders could occasionally demand a co-signer (a individual who agrees to pay a borrower's credit card debt should they default) for unsecured loans Should the lender deems the borrower as dangerous.

Collateral—only relates to secured loans. Collateral refers to something pledged as safety for repayment of the loan in case the borrower defaults

A loan is a deal concerning a borrower and also a lender in which the borrower gets an sum of money (principal) that they're obligated to pay back in the future. Most loans can be categorized into among three categories:

Incorporate an origination price (optional). An origination fee is really a proportion of the loan that goes for the lender, usually one% to 10% in the loan amount of money. Not all lenders cost an origination fee. You sometimes find out whether or not you’ll spend a single and exactly how much it can be after you receive a loan give.

Forbes Advisor adheres to demanding editorial integrity standards. To the top of our awareness, all written content is accurate as in the day posted, while delivers contained herein may no longer be obtainable.

Two frequent bond types are coupon and zero-coupon bonds. With coupon bonds, lenders foundation coupon desire payments over a proportion in the encounter price. Coupon desire payments occur at predetermined intervals, typically every year or semi-annually.

Many comparison Sites provide authentic-time interest level prices here so that you can Look at and shop determined by the loan standards along with your have economical and credit picture.

The methods previously mentioned is probably not applicable for all loans. Also, it is vital To judge regardless of whether repaying loans faster is really clever economically. While creating further payments toward your loans are perfect, they aren't Certainly vital, and you'll find prospect prices that deserve thought.

Refinancing and equity guideToday's refinance ratesBest refinance lenders30-yr preset refinance rates15-yr set refinance ratesBest money-out refinance lendersBest HELOC Lenders

Jaleel White Then & Now!

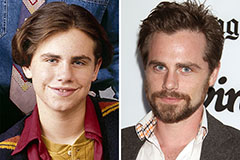

Jaleel White Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!